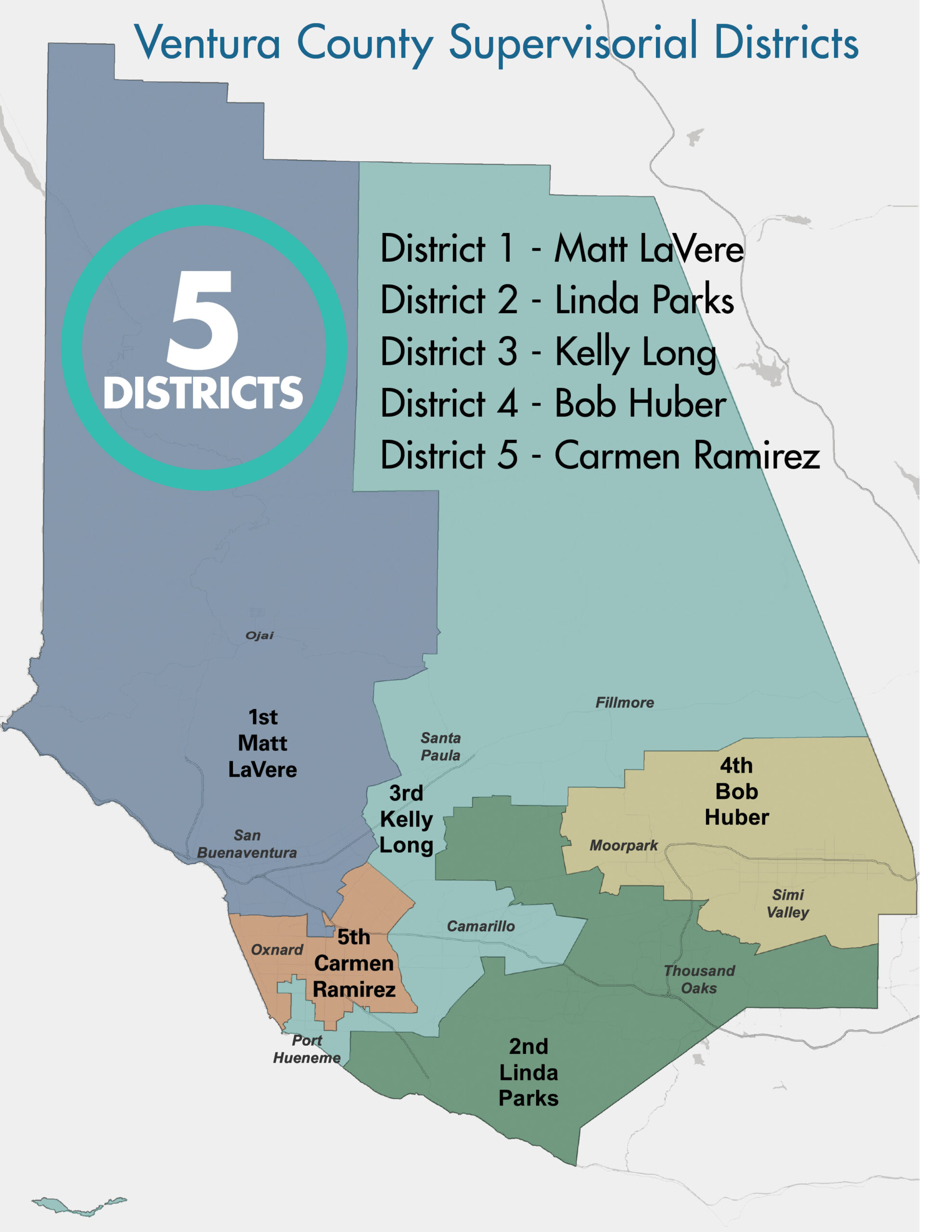

ventura property tax rate

Whether you are already a resident or just considering moving to Ventura to live or invest in real estate estimate local property tax rates and learn. El Tejon Unified 2.

Simi Valley Industrial Property 220 W Los Angeles Ave Simi Valley Ca 93065 Usa Real Estate Listing Quantumlisting

California State Property Tax.

. Learn all about Ventura real estate tax. The median property tax also known as real estate tax in Ventura County is based on a median home value of and a median effective property tax rate of 059. Ventura City 186 05 1034700 1169900.

Property Tax- Description - Ventura County. For example in Moorpark the average rate is 10751 while in Simo Valley it is 10772. Cuyama Joint Union 7 51 1057790.

Property Tax Rate. Oxnard additionally has a 945 total sales. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate.

County of Ventura - WebTax - Search for Property. Supplemental taxes result from assessments adjusting taxes when new taxable values are determined following change of ownership of locally-assessed property or completion of new. Pay Your Taxes - Ventura County.

By Phone - Call 805 654-2287 800 am to 500 pm By Fax - Fax 805 645-1305. Ventura County has one of the higher property tax rates in the state at around 1095. Property Tax- Description - Ventura County.

Ventura County Sales Tax. Conejo Valley Unified Out 48 89 1043800 1047300. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700.

Thousand Oaks includes Newbury Park and Ventura area of Westlake Village 10400. Briggs Out 5 55 1116400 1124238. 30 out of 58 counties have lower.

Tax Rates and Info - Ventura County. Tax Rate Database - Ventura County. 1215 ANCHORS WAY 75 VENTURA.

The Ventura County property tax rate is 125 of the. Learn how Ventura County sets its real property taxes with our. 1 is the max that the.

Tax Rate Database - Ventura County. Property tax process on a county-by-county basis. Revenue Taxation Codes.

Ventura County Property Tax. California State Sales Tax. Per state law 2nd installments cannot be paid until after payment of the.

As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. Ventura County Property Tax.

Ventura City Sales Tax. California State Sales Tax. Ventura County collects on average 059 of a propertys.

Tax Rates and Other Information - 2021-2022 - Ventura County. Ventura County collects on average 059 of a propertys. The tax rate of your municipality can vary.

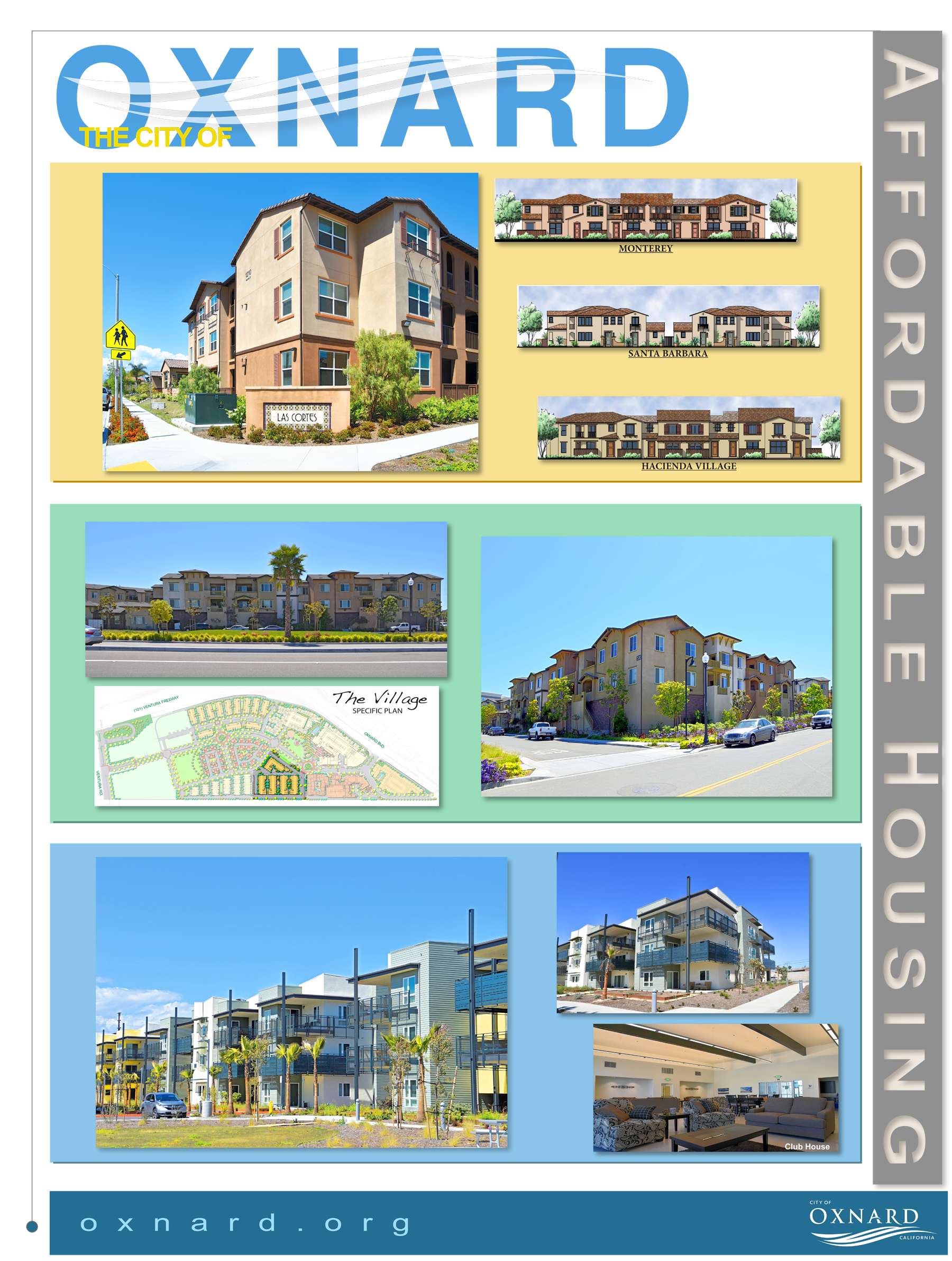

How much are property taxes in Oxnard California. Ventura County Sales Tax.

The Best Property Management Companies In Ventura California Of 2022 Propertymanagement Com

Californians Adapting To New Property Tax Rules City National Bank

Michigan S Property Tax Rate Among Highest In Nation Across Michigan Mi Patch

How To Transfer California Property Tax Base From Old Home To New

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Pay Property Taxes Online County Of Ventura Papergov

Ventura And Los Angeles County Property And Sales Tax Rates

Property Tax California H R Block

%20(002)NEOGOVWEBSITE.png)

Employment Opportunities Sorted By Job Title Ascending Welcome To The County Of Ventura

Los Angeles County Ca Property Tax Search And Records Propertyshark

Property Tax Information Moorpark Ca Official Website

Greater Oxnard Ca Commercial Property For Sale Officespace Com

Oxnard Affordable Housing City Of Oxnard

Yuba County Ca Property Tax Search And Records Propertyshark

County Of Ventura Webtax Search For Property

Taxation In California Wikipedia

Expert Advice For Moving To Ventura Ca 2022 Relocation Guide